Flexible Forex Trading

Is Forex Trading a Good Idea?

Forex trading, also known as foreign exchange trading, is the practice of buying and selling currencies to make a profit. It operates in the largest financial market in the world, with a daily turnover exceeding $6 trillion. Given the market’s size and liquidity, it offers vast opportunities but also presents significant risks.

The question, “Is forex trading a good idea?” depends largely on one’s objectives, risk tolerance, and knowledge of the market. Forex trading can be a lucrative venture, but it is important to acknowledge that it is not suitable for everyone. Those who are well-educated about the intricacies of forex trading, use effective risk management strategies, and are willing to dedicate time to learning and practicing can succeed. However, for those who are uninformed or seek quick, easy profits, forex trading can be highly risky.

The major advantages of forex trading include the following:

Liquidity: Forex is one of the most liquid markets in the world, meaning traders can easily enter and exit positions without worrying about price manipulation or delays.

Accessibility: The forex market is open 24 hours a day, five days a week, making it easy for traders to access the market at their convenience.

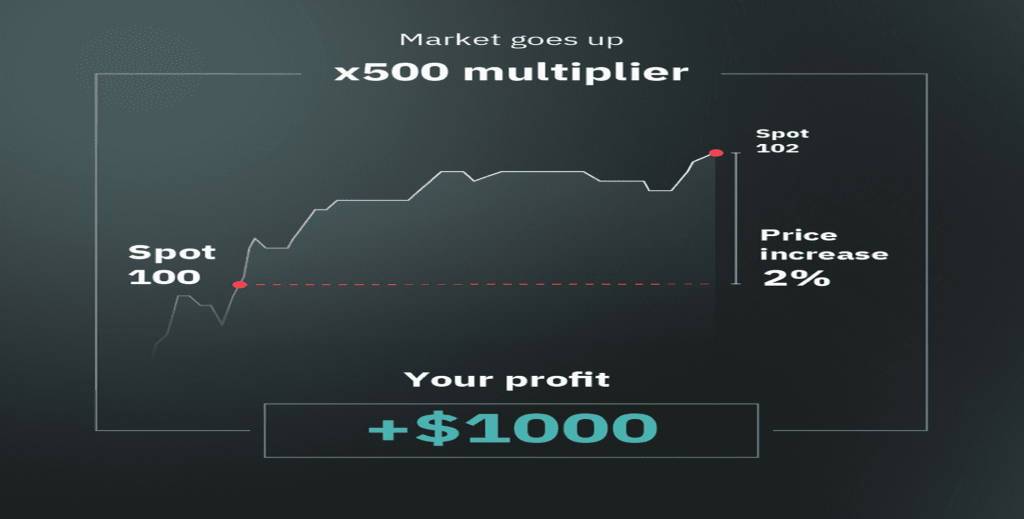

Leverage: Forex trading often allows for significant leverage, enabling traders to control larger positions with a smaller capital outlay.

Profit Potential: Due to the high volatility in forex markets, traders can profit from both rising and falling markets.

However, there are notable drawbacks, including the risk of loss, the need for continuous learning, and the complexity of analyzing multiple factors affecting currency values. Moreover, the leverage available in forex trading can amplify both profits and losses.

In conclusion, forex trading can be a good idea if approached with caution, a solid strategy, and ongoing education. It is not a get-rich-quick scheme, and it’s important to understand both the risks and rewards involved.

How Do You Earn Money in Forex?

Earning money in forex trading primarily comes down to buying and selling currency pairs at profitable prices. To do this, you’ll need to anticipate changes in currency value over time. Here are the core ways in which forex traders make money:

Currency Price Movement: Forex traders earn money by taking advantage of price fluctuations in currency pairs. For example, if you believe that the EUR/USD pair will go up, you can buy the pair. If the price goes up, you sell it for a profit. Conversely, if you think the EUR/USD pair will go down, you can sell it first and later buy it back at a lower price to profit from the decline.

Leverage: Leverage allows traders to control a large position with a smaller amount of capital. For example, with 100:1 leverage, you can control $100,000 with just $1,000 of your capital. If the market moves in your favor, you can make significant profits, but if it moves against you, losses are magnified.

Interest Rate Differentials (Carry Trade): A carry trade involves borrowing in a currency with a low interest rate and investing in a currency with a high interest rate. The interest rate differential can generate passive income for forex traders, although this strategy also carries significant risks.

Automated Trading: Some forex traders use algorithmic trading or automated trading systems that can execute trades based on pre-determined conditions, thus reducing human errors and emotions. These systems can be profitable if well-designed, but they require technical expertise to set up and monitor.

It’s important to note that making money in forex trading isn’t easy. Successful traders usually employ a combination of technical analysis, fundamental analysis, risk management, and disciplined execution to achieve consistent profitability.

Which Website is Best for Forex Trading?

Selecting the best forex trading platform is essential for your success as a trader. The right platform will offer competitive spreads, reliable execution, and useful tools for analysis and risk management. Below are some of the top forex trading platforms for beginners and experienced traders:

MetaTrader 4 (MT4): MT4 is one of the most popular forex trading platforms globally. It provides a user-friendly interface, a range of charting and analysis tools, and supports automated trading via Expert Advisors (EAs). MT4 is ideal for traders who prefer technical analysis and want to automate their strategies.

MetaTrader 5 (MT5): MT5 is the successor to MT4, offering more advanced features such as additional timeframes, order types, and an economic calendar. It’s also suitable for trading other financial instruments like stocks and commodities.

cTrader: Known for its intuitive interface and advanced charting tools, cTrader is a favorite for traders who prioritize speed and smooth execution. It also offers automated trading through cAlgo.

NinjaTrader: While it’s primarily known for futures and stock trading, NinjaTrader is also a great option for forex traders, offering advanced charting, analysis tools, and a high degree of customization.

eToro: eToro is a social trading platform that allows users to copy the trades of successful traders. It’s an ideal platform for beginners who want to learn from others and start with smaller amounts of capital.

IG Group: IG is a highly respected forex broker with a long-standing reputation in the industry. It offers a range of trading tools, educational resources, and competitive spreads.

When choosing a platform, consider factors such as customer support, security, available currency pairs, transaction fees, and the ease of depositing and withdrawing funds.

How Much Do I Need to Start Forex Trading?

The amount of capital you need to start trading forex depends on several factors, including your trading style, risk tolerance, and leverage used. Some forex brokers allow you to start trading with as little as $1, but it’s generally advisable to have at least $100 to $500 for a more comfortable experience.

Here’s a breakdown of how different factors influence the amount you need to start forex trading:

Leverage: Leverage enables you to control a larger position with a smaller capital outlay. For instance, with 100:1 leverage, you can control a $100,000 position with just $1,000. However, leverage also increases risk, and it’s possible to lose more than your initial deposit if the market moves against you.

Trading Style: Day traders or scalpers typically need more capital to sustain multiple trades in a day, while swing traders or long-term traders might require less initial capital.

Risk Management: It’s essential to use effective risk management strategies, such as setting stop-loss orders, to protect your capital. A good rule of thumb is to risk no more than 1-2% of your capital on any single trade.

Starting with a modest amount, such as $500, will allow you to practice trading without risking too much capital. As you gain more experience and confidence, you can consider increasing your trading capital.

How Do I Teach Myself to Trade Forex?

Learning forex trading can seem overwhelming at first, but with dedication and the right resources, you can teach yourself how to trade effectively. Here are some steps to help you get started:

Start with the Basics: Learn the basic concepts of forex trading, such as currency pairs, pips, spreads, and leverage. Understanding these fundamentals will help you make informed decisions as you progress.

Study Technical and Fundamental Analysis: Technical analysis involves analyzing past price movements using charts and indicators, while fundamental analysis involves studying economic news and events that affect currency values. Both approaches are crucial for predicting price movements.

Use Demo Accounts: Most forex brokers offer demo accounts that allow you to practice trading with virtual money. This is an essential tool for beginners to familiarize themselves with the platform and practice trading strategies without risking real capital.

Read Books and Take Courses: There are numerous books, online courses, and webinars available that can teach you advanced trading strategies and techniques. Invest time in self-education.

Join Forex Communities: Engage with other traders through online forums and social media groups. Joining forex communities can provide insights, tips, and support from experienced traders.

Start Small and Gradually Increase Your Risk: As you gain confidence and experience, you can start trading with small amounts and gradually increase your risk as you become more skilled.

How Much Can I Make as a Beginner in Forex?

As a beginner, your potential earnings in forex trading can vary widely depending on your initial capital, trading strategy, and risk management skills. While it’s possible to make significant profits, it’s equally likely to experience losses.

Realistic Expectations: Many beginners start with small amounts, such as $500 or $1,000, and aim to achieve modest profits of 5-10% per month. However, aiming for higher returns can result in higher risk.

Compounding: As you gain experience and start making consistent profits, you can compound your earnings by reinvesting your profits into larger trades. This process can lead to more substantial returns over time.

Risk Management: Successful traders focus on minimizing losses through effective risk management strategies. This helps ensure that even if you experience losing trades, they don’t wipe out your entire account balance.

Overall, the amount you can make as a beginner depends on your learning curve, strategy, and how well you manage risk. It’s important to focus on learning and improving your skills rather than expecting immediate, high returns.

How Long Does It Take to Learn Forex?

The time it takes to learn forex trading varies from person to person. For most beginners, it typically takes several months to understand the basic concepts and gain confidence in trading. However, becoming proficient and consistently profitable can take years of practice.

Here are a few factors that affect how long it takes to learn forex:

Dedication and Practice: The more time you dedicate to learning and practicing, the faster you will progress. Using demo accounts and studying market trends will help accelerate your learning.

Trading Style: If you prefer short-term trading (day trading or scalping), it may take less time to develop a strategy, as these methods focus on quick decisions. Longer-term traders (swing traders) often require more time to learn how to analyze market trends.

Mentorship and Resources: Access to quality mentorship or learning resources can significantly speed up the process. Learning from experienced traders or using structured courses can help you avoid costly mistakes.

In general, expect to spend at least six months to a year learning the ropes, but mastery of forex trading will likely take several years of continuous learning.

What is the Best Currency to Trade in Forex as a Beginner?

For beginners, it’s often recommended to trade major currency pairs because they are more liquid and less volatile than exotic pairs. The most commonly traded currency pairs are:

EUR/USD: The Euro/US Dollar pair is the most traded in the world. It’s highly liquid and influenced by key economic data from both the Eurozone and the United States.

GBP/USD: The British Pound/US Dollar pair is another popular option, offering good liquidity and volatility for traders who are comfortable with a little more risk.

USD/JPY: The US Dollar/Japanese Yen pair is known for its stability and liquidity, making it a popular choice for both beginners and experienced traders.

As a beginner, it’s advisable to stick with these major pairs, as they are less affected by sudden price fluctuations compared to exotic pairs.

Can I Start Forex with 500?

Yes, you can start forex trading with $500. Many brokers allow you to open a micro account with small initial deposits. However, it’s important to note that trading with smaller amounts requires careful risk management. It may take longer to see significant returns with a smaller capital, and losses can accumulate quickly if you don’t manage your trades well.

To start forex trading with $500:

Use Leverage Wisely: Leverage can amplify both gains and losses, so it's essential to use it cautiously.

Practice with a Demo Account: Before committing to real money, practice on a demo account to refine your strategy.

Focus on Risk Management: Aim to risk no more than 1-2% of your capital on any single trade.

Starting with $500 can give you a good foundation to learn, but keep your expectations realistic as you gain experience.

No comments yet