What Is Your Financial Literacy IQ and What You Can Do to Increase It?

Financial Literacy is something that affects billions of people worldwide, and statistics show that only about 24 percent of Americans can demonstrate basic financial literacy.

Unfortunately, financial literacy is not something that has been taught in schools throughout our history.

When you become financially literate, you will no longer make the financial mistakes of your past.

Bad financial decisions have kept Americans trapped in the Debt System for years and without the financial education that is drastically needed, they will remain trapped until they take responsibility for their financial future.

In 2003, The Financial Literacy and Education Commission (FLEC) was established under the Fair and Accurate Credit Transactions Act.

FLEC was tasked to develop a national financial education website and a national strategy on financial education.

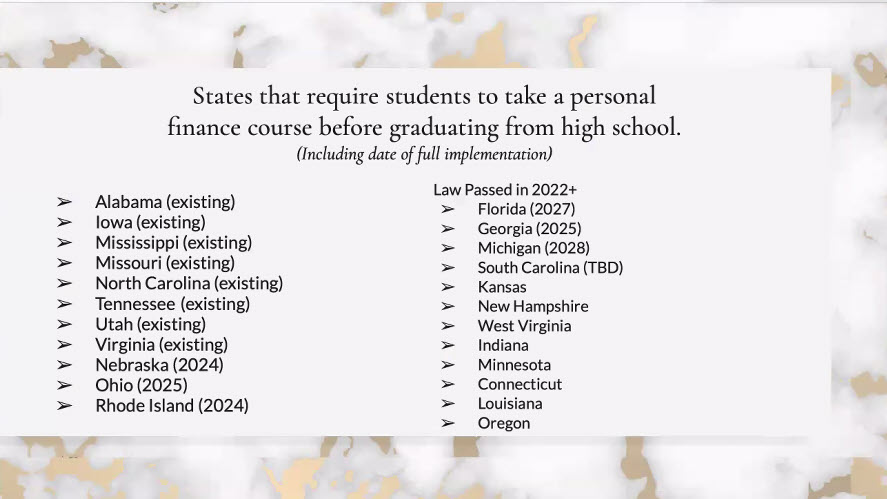

According to the image below only 23 states have a requirement to teach a financial course before students graduate high school:

Financial Literacy Begins at Home!

For many Americans what we know about Financial Literacy was taught to us by our parents or grandparents. Unfortunately, if they were not taught about financial literacy, there was nothing to pass on to their children.

What most of us got from our parents or grandparents was “got to school, get a good education, so that we could get a good job!”

That strategy worked fine during the Industrial Age when you could participate in “The 40-40-40 Plan” where you could work 40 hours a week for 40 years to retire with 40 percent of your income and if you were lucky, a gold watch!

Most of us can’t survive off 100 percent of our income!

If we were not taught about financial literacy, we probably have not put anything away for our retirement and would be forced to rely on Social Security in our retirement.

Some may have put money in a company sponsored 401k or an IRA, but in most cases it may not be enough.

In the past we were taught that having $1,000,000 in our retirement accounts would be enough to last us during our retirement years.

With the advances in medical technology, we are living longer and require more than 1 million in our retirement accounts.

If we retire at 62 and we have 1 million in our retirement accounts, and we live another 25 years, that will mean we would have approximately $40,000 a year in retirement income.

Most of us do not account for the taxes that we would have to pay if our money was not in a Tax-Free retirement vehicle.

What if you do not have 1 million in your retirement accounts?

What if you only have Social Security to rely on in your retirement years.

It’s not too late to start a Financial Education Program so that you can learn how to make better financial decisions.

Click the link below to take a basic Financial Literacy questionnaire to test your knowledge:

http://testmyfinancialliteracyiq.com

Someone from my team will get in touch with you to discuss the results and help you move forward with your financial education.

To a better financial future,

Steven Dobson

Financial Educator

No comments yet